Currently Empty: US$0.00

With the rapid rise of cryptocurrencies in recent years, learning all about the US regulations on cryptocurrency has become a crucial aspect for investors, traders, and businesses. We’ve prepared a comprehensive guide to federal and state laws regarding cryptocurrency to help you navigate this complex landscape.

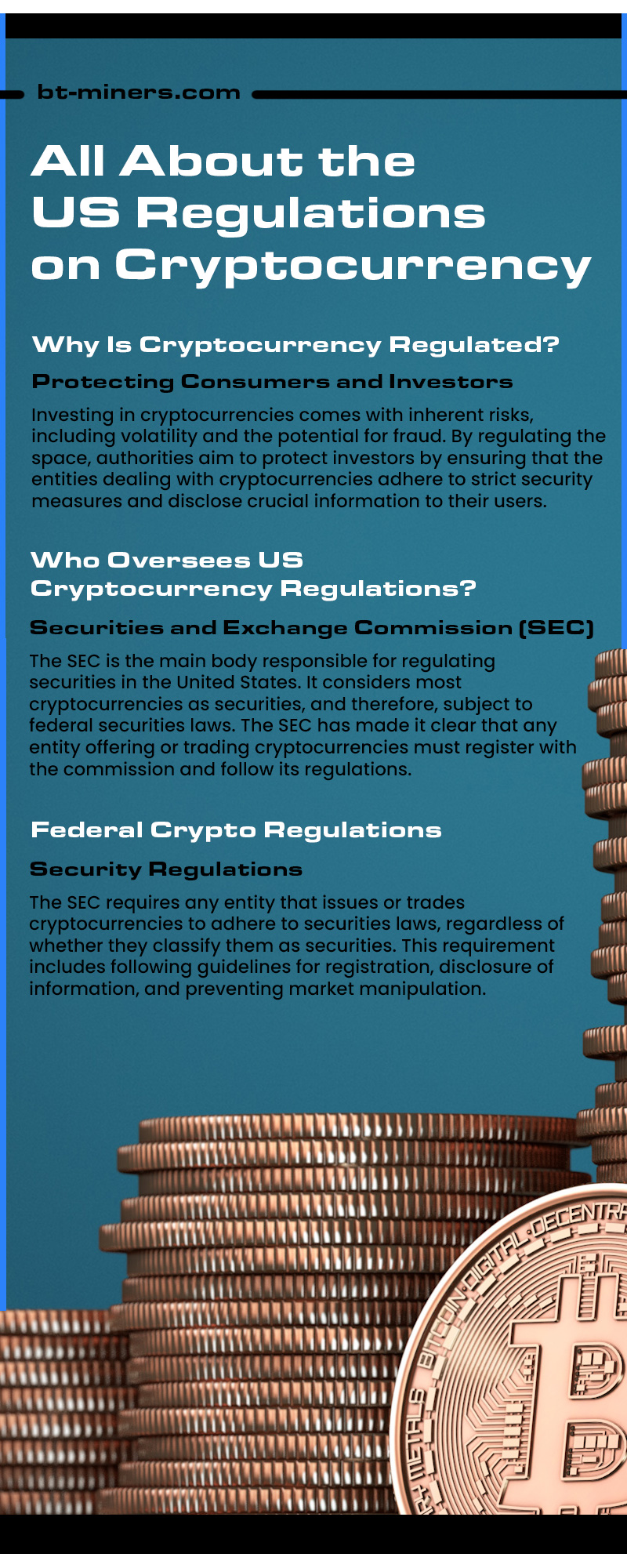

Why Is Cryptocurrency Regulated?

Cryptocurrencies, such as Bitcoin and Ethereum, have continued to gain popularity. Therefore, lawmakers and regulators are stepping up their efforts to impose rules that protect consumers, promote transparency, and combat illegal activities.

Protecting Consumers and Investors

Investing in cryptocurrencies comes with inherent risks, including volatility and the potential for fraud. By regulating the space, authorities aim to protect investors by ensuring that the entities dealing with cryptocurrencies adhere to strict security measures and disclose crucial information to their users.

Promoting Transparency and Preventing Financial Crimes

Greater transparency is another critical aspect of cryptocurrency regulation, as the anonymous nature of transactions has made it a popular medium for illegal activities such as money laundering and terrorist funding. Regulators have been working together to establish guidelines for cryptocurrencies and exchanges, wallets, and other related services. By enforcing anti-money laundering (AML) and know-your-customer (KYC) regulations, they seek to curb such criminal activities.

Enhancing Market Stability

The inherent volatility of cryptocurrencies has raised concerns about their potential impact on the financial system. Through regulation, authorities attempt to mitigate potential risks by monitoring the activities of crypto players and imposing restrictions where necessary. This monitoring, in turn, helps maintain economic stability and investor confidence in the market.

Who Oversees US Cryptocurrency Regulations?

The primary government bodies responsible for overseeing and defining regulations for cryptocurrencies are the Securities and Exchange Commission (SEC), the Financial Crimes Enforcement Network (FinCEN), and the Commodities Futures Trading Commission (CFTC). Here’s a breakdown of their roles and standpoints when it comes to cryptocurrency:

Securities and Exchange Commission (SEC)

The SEC is the main body responsible for regulating securities in the United States. It considers most cryptocurrencies as securities, and therefore, subject to federal securities laws. The SEC has made it clear that any entity offering or trading cryptocurrencies must register with the commission and follow its regulations.

Financial Crimes Enforcement Network (FinCEN)

FinCEN, acting as a bureau under the US Department of the Treasury, directs its efforts toward combating financial crimes, including money laundering. FinCEN has declared that anyone involved in exchanging, transmitting, or administering cryptocurrencies must register as a Money Services Business (MSB) and comply with anti-money laundering (AML) and know-your-customer (KYC) rules.

Commodities Futures Trading Commission (CFTC)

The CFTC sees cryptocurrencies as commodities rather than securities. While it doesn’t directly regulate cryptocurrency exchanges, it does have jurisdiction over derivatives products based on cryptocurrencies, such as futures and swaps.

Federal Crypto Regulations

The current regulatory landscape surrounding cryptocurrencies in the US is a patchwork of federal and state-level laws and regulations. However, some overarching federal rules apply to all players operating in the crypto space.

Security Regulations

The SEC requires any entity that issues or trades cryptocurrencies to adhere to securities laws, regardless of whether they classify them as securities. This requirement includes following guidelines for registration, disclosure of information, and preventing market manipulation.

Anti-Money Laundering Regulations

All businesses involved in cryptocurrency transactions must comply with FinCEN’s AML regulations. This compliance includes registering as an MSB and implementing KYC procedures to verify the identities of their users and monitor suspicious activities.

Tax Regulations

The Internal Revenue Service (IRS) considers cryptocurrencies property. This consideration means that any gains from buying and selling cryptocurrencies are subject to capital gains tax. Failure to report these gains accurately can result in penalties or even criminal charges.

Consumer Protection Regulations

In addition to federal regulations, individual states may also have laws surrounding the use and trading of cryptocurrencies. These laws aim to protect consumers by ensuring that companies follow fair practices and disclose all relevant information to their customers.

As the cryptocurrency market continues to evolve and grow, so will its surrounding regulations. More clarity and consistency in federal regulations will emerge in the future, as lawmakers and regulators continue to work together to strike a balance between promoting innovation and protecting consumers.

State Crypto Regulations

Some states have taken a more proactive approach toward regulating digital assets, while others have chosen to adopt a wait-and-see approach.

New York

New York is one of the first states to introduce regulations for cryptocurrencies, with its BitLicense program. This program requires companies dealing with virtual currencies to obtain a license from the New York State Department of Financial Services (NYDFS). The stringent requirements have caused some companies to withdraw operations from New York, but it has also established consumer protection and promoted transparency in the state’s crypto market.

Wyoming

On the other end of the spectrum is Wyoming, which has been dubbed the “Crypto Cowboy” state for its crypto-friendly laws. In 2019, it passed over a dozen blockchain and cryptocurrency-related bills, including laws defining virtual currencies as legal property and exempting them from property taxes. This exemption has attracted many companies to set up shop in Wyoming, making it a hub for blockchain and crypto innovation.

California

In California, cryptocurrencies are not explicitly regulated at the state level, but the state does have a Virtual Currency Act that requires businesses handling virtual currencies to obtain a license from the California Department of Business Oversight. Additionally, the state also has consumer protection laws that apply to cryptocurrency transactions.

Texas

Texas has also taken a somewhat hands-off approach to regulating cryptocurrencies, with no specific laws or regulations. However, its securities laws may still apply to certain crypto activities. In 2017, the state’s Securities Commissioner issued an emergency cease and desist order against a cryptocurrency cloud mining company for allegedly defrauding investors.

Other states such as Massachusetts, New Hampshire, and Colorado, also have varying degrees of regulatory frameworks for cryptocurrencies. As the space continues to evolve, more states will likely follow suit in implementing regulations to protect consumers and promote transparency in the cryptocurrency market.

The US has taken steps towards establishing guidelines for the growing cryptocurrency industry, from federal regulations set by government bodies to state-level laws. While these regulations may vary across states, their goal is to protect consumers, promote transparency, and prevent financial crimes. Learning all about the US regulations on cryptocurrency and staying compliant is crucial for businesses and individuals to ensure a safe and stable market for all due to cryptocurrencies’ constantly evolving nature.

As you explore investing in cryptocurrency, don’t forget to look into BT-Miners’ Altcoin mining hardware, a surefire way to maximize your crypto gains in today’s rapidly evolving digital landscape. Our top-of-the-line technology and expert team ensure you stay ahead of the curve and reap maximum profits from your cryptocurrency investments.

+1-813-820-0668

+1-813-820-0668 +971-800-012-0089

+971-800-012-0089 +91-22-5032-3009

+91-22-5032-3009 +44-333-015-6152

+44-333-015-6152 +61-2-8074-3443

+61-2-8074-3443